wv estate tax return

Commerce over the territory of the state and therefore are exempt from ad valorem property tax and do not have a tax situs in West Virginia for purposes of ad valorem taxation. Tax Return will also be required to file a West Virginia Estate Tax Return.

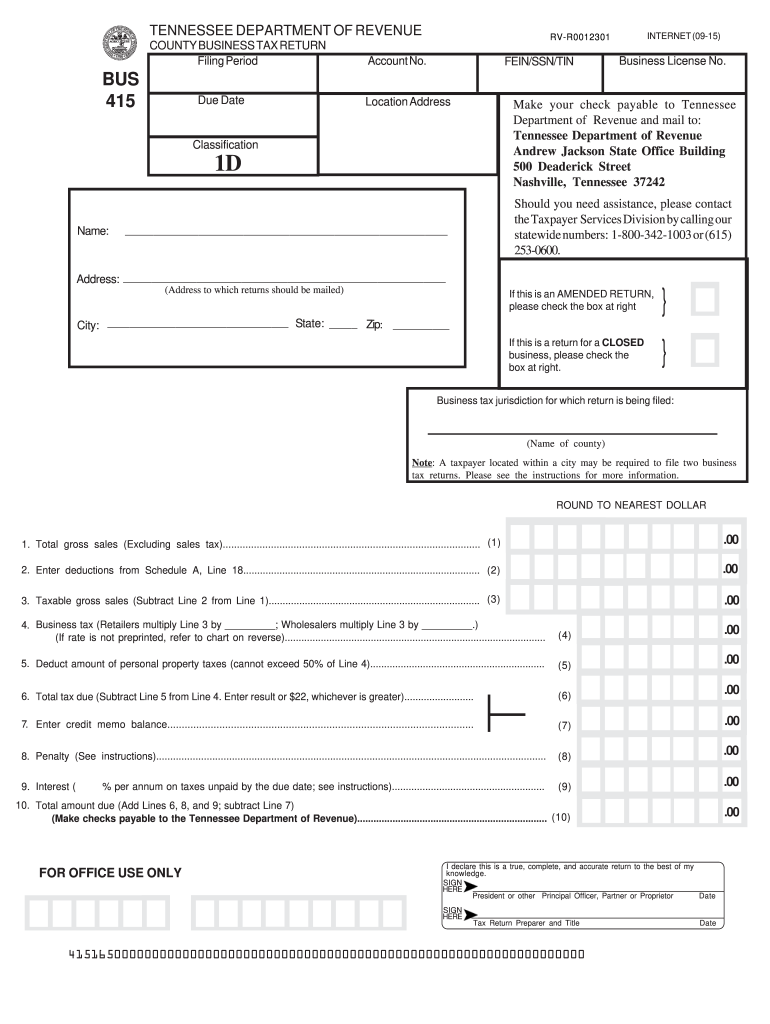

Tn Dor Bus 415 2015 2022 Fill Out Tax Template Online Us Legal Forms

Interest and Additions to Tax Calculator Enter tax amount submitted.

. Based on filing status here. Check TaxWVGov for the latest tax information. For other forms in the Form 706 series and for Forms 8892 and 8855 see the related.

The proper forms and instructions will be sent to the ExecutorAdministrator after the appraisement has been filed. West Virginia Tax Brackets. Box 509 Fayetteville WV 25840.

Declaration of preparer other than personal representative is based on all information of which. Sheriff of Fayette County PO. You as executor can.

Any estate required to file a Federal Estate Tax Return Form 706 will be required to file a West Virginia Estate Tax Return. Below are five simple steps to get your wv state tax department fiduciary estate tax return forms 2008 eSigned without leaving your Gmail account. Fillable-Forms Forms and Instructions Booklet Prior Year Forms.

If you are required to pay out the. For tax year 2021 the due date for an annual Estate or Trust West Virginia Fiduciary Income Tax return is April 18 2022. 05312002 Enter date the payment is to be made.

TaxHelpWVGov 2020 State Tax Filing Deadline. 31 2021 can be prepared and e-Filed now along with an IRS or Federal Income Tax Return or you can learn how to only prepare and file a WV state return. Please wait at least eight weeks before checking the status of your refund.

Enter date the return is due. The Estates Income Tax Return The Estates Tax Year. For decedents dying July 13 2001 and after a release or certificate of non-liability from the West Virginia State Tax Department.

When sending payments by mail please enclose a self addressed stamped envelope for return receipt. STATE TAX DEPARTMENT SPECIAL AUDITS ESTATE TAX UNIT POST OFFICE BOX 1923 CHARLESTON WV 25327 Under penalty of law I declare that I have examined this return and to the best of my knowledge and belief it is a true correct and complete return. 304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map.

See reviews photos directions phone numbers and more for the best Tax Return Preparation-Business in Moundsville WV. In addition to the individual tax return and the estate income tax return it may also be necessary for an executor to file a US Estate Tax Return Form 706. Payment of Additional Estate Taxes in WV.

Before filing form 1041 you will need to obtain a tax. Your taxpayer ID Social Security number of the first person shown on the return The tax year. IT-140 West Virginia Personal Income Tax Return 2021.

Article 10 Chapter 11 of the West Virginia Code. You will be prompted to enter. Open the email you received with the documents that need signing.

Log in to your account. A full-year non-resident of West Virginia and have source income mark IT-140 as Nonresident and complete Column C of Schedule A Considered a part-year. Go to the Chrome Web Store and add the signNow extension to your browser.

The Department of Revenue administers and enforces West Virginia revenue laws including the regulation of insurance banking and gaming industries as well as. The exemption is portable for spouses meaning that with the right legal steps a couple can protect 2406 million after both spouses have died. A real estate deputy assessor will be.

31 rows Generally the estate tax return is due nine months after the date of death. Up to 25 cash back Form 1041. The taxable year of the estate or trust for West Virginia income tax purposes is the same as the one used for federal tax purposes.

West Virginia State Income Taxes for Tax Year 2021 January 1 - Dec. The depreciation schedule can be found on Form 4562 of your tax return. Find IRS or Federal Tax Return deadline details.

The taxable year of the estate or trust for west virginia income tax purposes is the same as the one used for federal tax purposes. See reviews photos directions phone numbers and more for Estate Tax Return Preparation locations in. To pay by mail please send to.

04152002 Enter date the return is to be filed. The West Virginia state income tax is similar in structure to the federal income tax. This final estate tax return is necessary only when an estate is large enough-at least 114 million in assets as of 2019-to require payment of estate taxes related to the.

The West Virginia tax filing and tax payment deadline is April 18 2022. Though there isnt an estate tax in Virginia you might have to pay the federal estate tax. To check the status of your West Virginia state refund online go to httpsmytaxeswvtaxgovlinkrefund.

Generally virginia does not require an estate tax return unless there is a federal estate tax return due. The gift tax return is due on April 15th following the year in which the gift is made. Stop by our office at 100 Church Street Fayetteville Monday - Friday 800 am.

STATE OF WEST VIRGINIA. The top tax rate for the federal estate tax. A full-year resident of West Virginia.

Use the IT-140 form if you are. Organize and gather 2021 tax records including Social Security numbers Individual Taxpayer Identification Numbers. The proper forms and instructions will be sent to the fiduciary once the appraisement has been received by the State Tax Department.

A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. Only estates subject to the tax imposed by West Virginia Code 11-11-3 will be issued a release of lien pursuant to West Virginia Code 11-11-17. To avoid processing delays and to speed the issuance of any refund the Tax Department urges people to follow these five steps.

The federal estate tax exemption is 1170 million in 2021 and goes up to 1206 million in 2022. Available for pc ios and android. 1-800-982-8297 Email Tax Support.

Report Tax Fraud Join the Tax Commissioners Office Mailing List Tax Information and Assistance. The estates tax year begins on the date on which the deceased person died. Then click Search to find your refund.

All estates get a 600 exemption.

Over 3 97 Crore Income Tax Returns Have Already Been Filed Till 24th Of December 2020 Have You Filed Yours As Yet I Income Tax Return Income Tax Tax Return

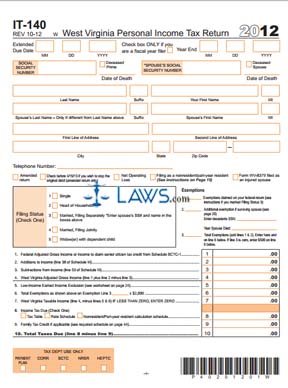

Free Form It 140 Personal Income Tax Return Free Legal Forms Laws Com

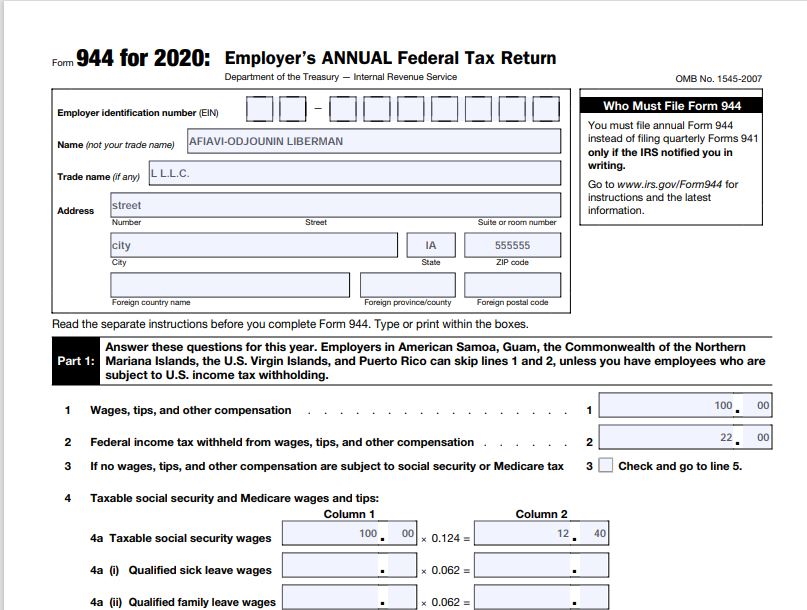

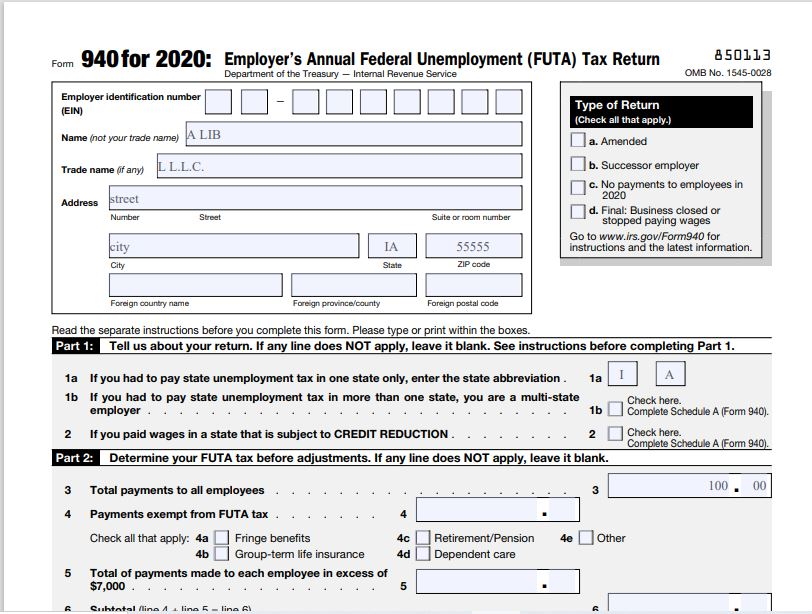

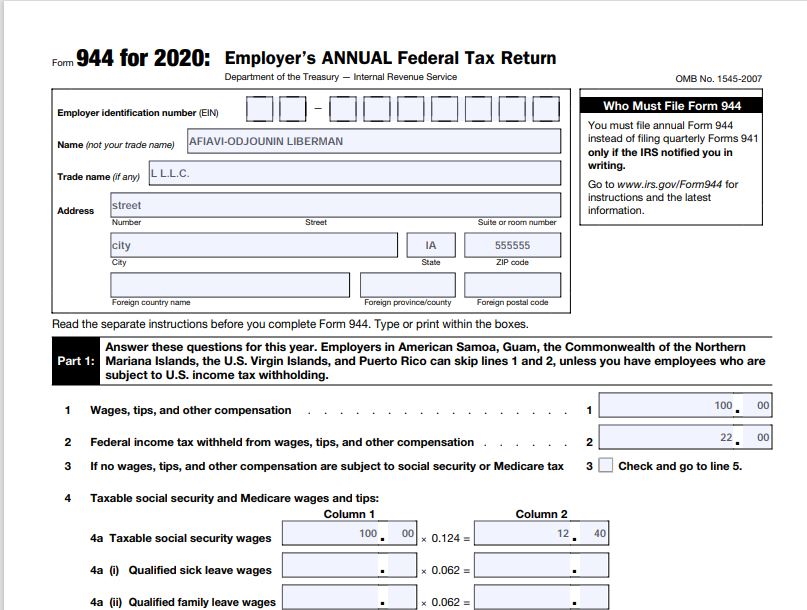

2020 Federal Tax Forms And Instructions Nina S Soap

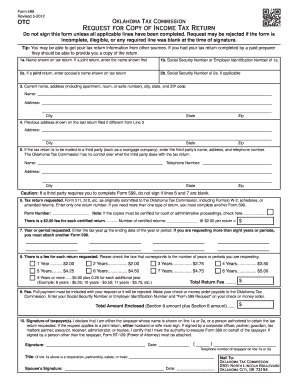

Form 599 Fill Out And Sign Printable Pdf Template Signnow

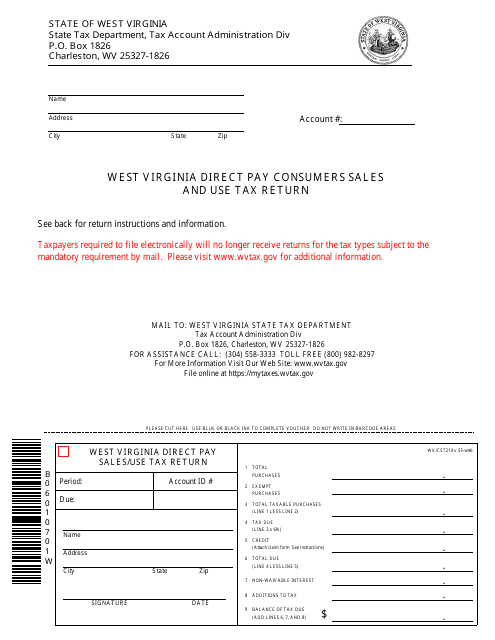

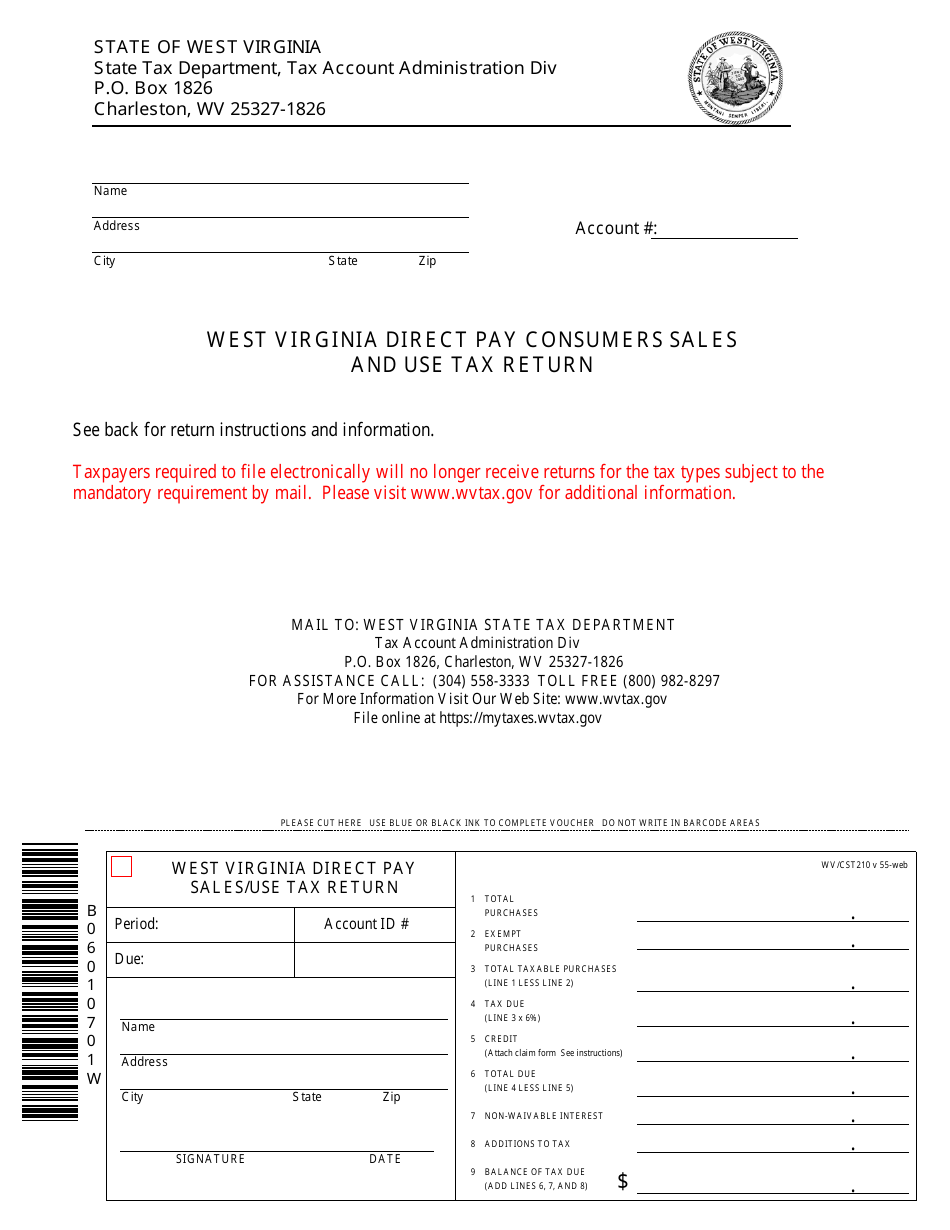

Form Wv Cst 210 Download Printable Pdf Or Fill Online West Virginia Direct Pay Consumers Sales And Use Tax Return West Virginia Templateroller

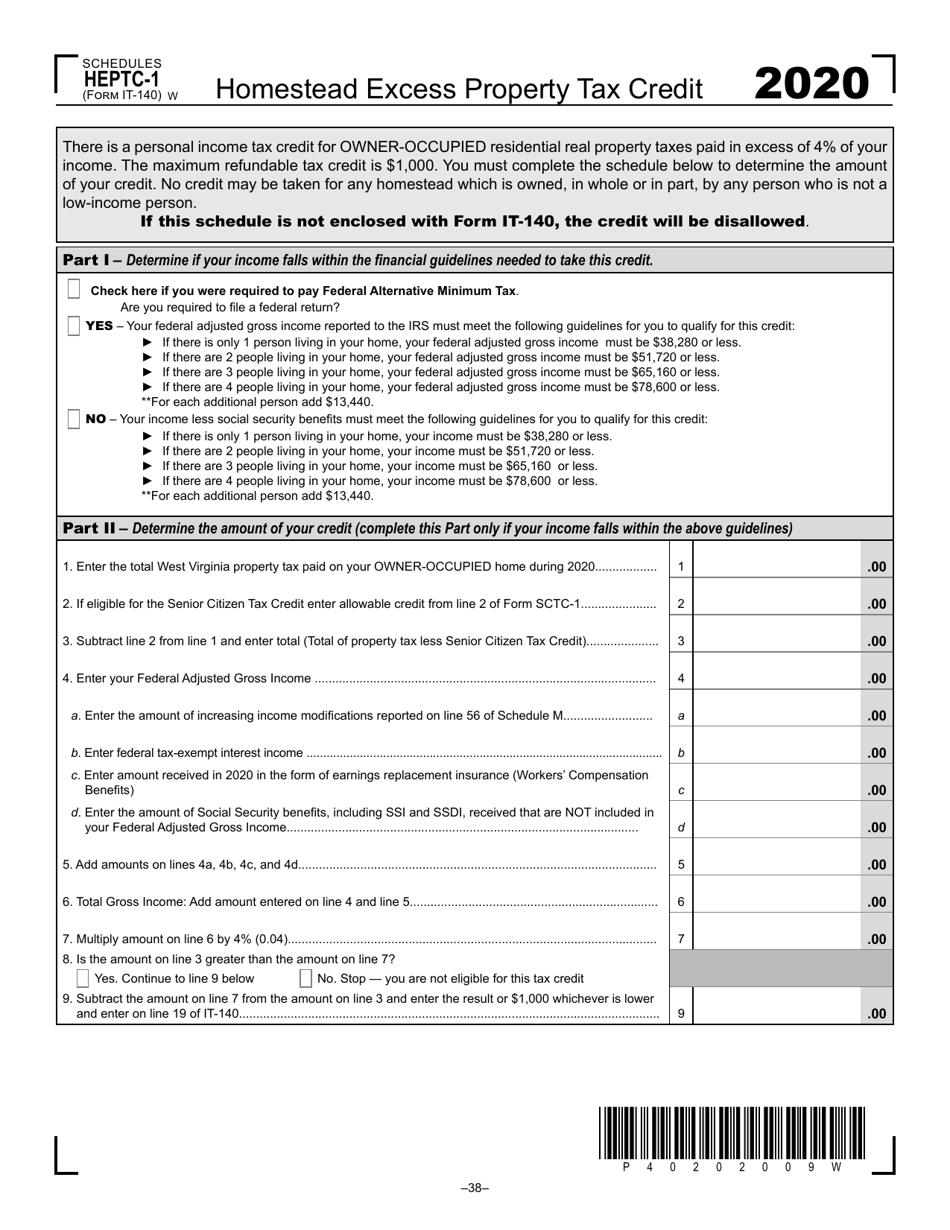

Form It 140 Schedule Heptc 1 Download Printable Pdf Or Fill Online Homestead Excess Property Tax Credit 2020 West Virginia Templateroller

Preston County Commission Online Records Preston County Records

State By State Guide To Taxes On Retirees Retirement Income Income Tax Tax Free States

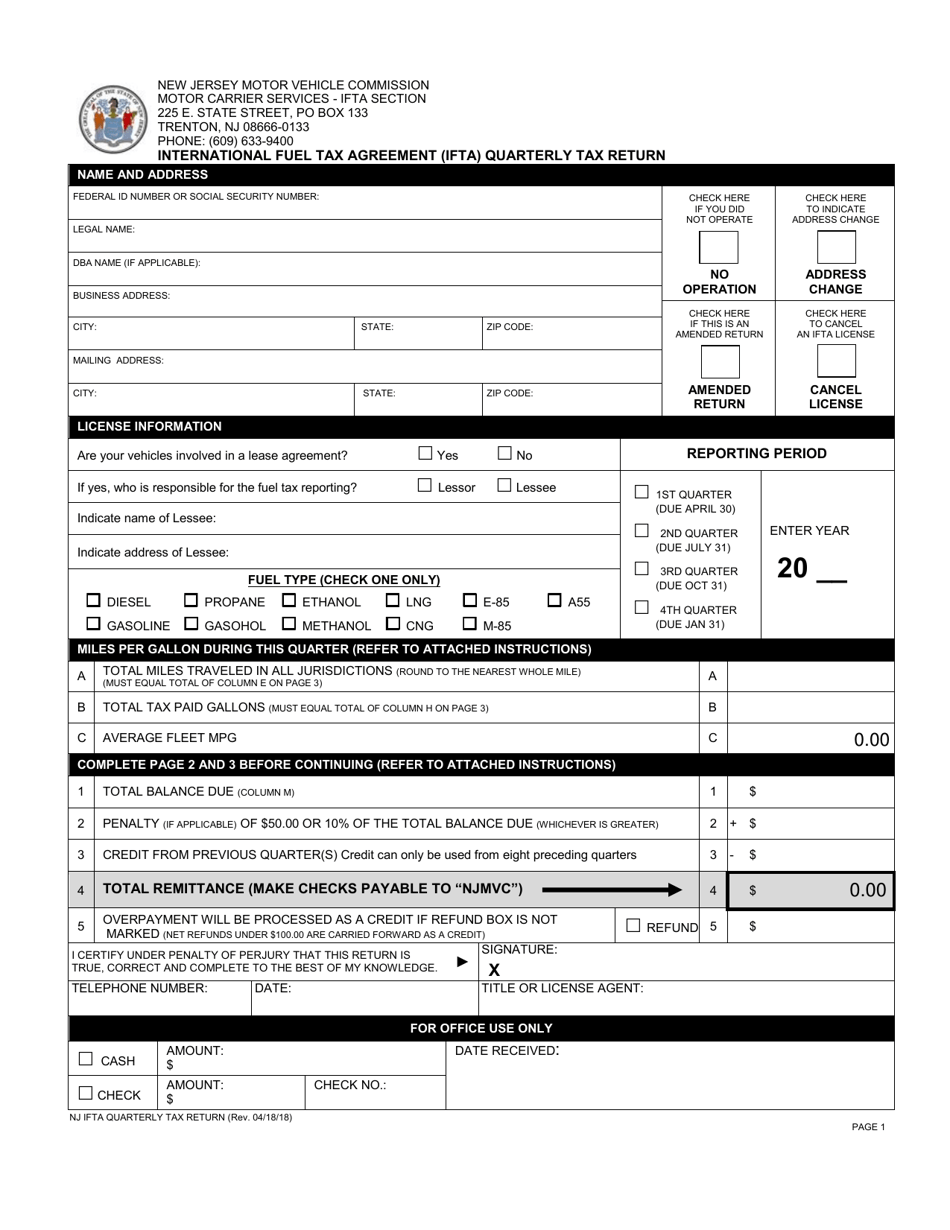

New Jersey International Fuel Tax Agreement Ifta Quarterly Tax Return Download Fillable Pdf Templateroller

Form Wv Cst 210 Download Printable Pdf Or Fill Online West Virginia Direct Pay Consumers Sales And Use Tax Return West Virginia Templateroller

Gap Between Homeowners Appraisers Narrows To Lowest Mark In 2 Years Real Estate Nj Real Estate Articles Real Estate Houses

2020 Federal Tax Forms And Instructions Nina S Soap

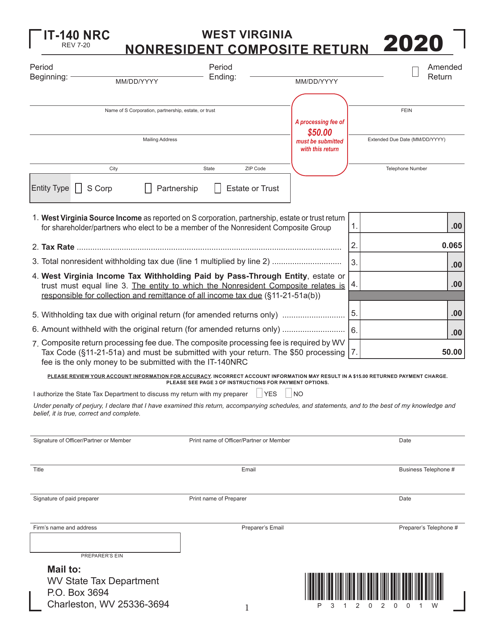

Form It 140 Nrc Download Printable Pdf Or Fill Online West Virginia Nonresident Composite Return 2020 West Virginia Templateroller