unemployment tax break refund mn

Individualincometaxstatemnus Business Income Tax Phone. Minnesota Department of Revenue Mail Station 0020 600 N.

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Individual Income Tax Phone.

/https://static.texastribune.org/media/files/9e39efec91f8d75616c08256f08c9a6d/TWC%20Unemployment%20Illo%20Final%20PPTT.JPG)

. State Taxes on Unemployment Benefits. Paul MN 55145-0020 Mail your tax. FOX 9 - Many Minnesota tax filers will get an automatic refund within weeks because of tax breaks passed overnight by lawmakers state Revenue Department.

On September 13th the State of Minnesota started processing refunds to. The Minnesota Department of Revenue is issuing the. The state of Minnesota had originally taxed the full amount of unemployment that you received in 2020.

The latest COVID-19 relief bill gives a federal tax break on unemployment benefits. State Income Tax Range. North Dakota taxes unemployment compensation to the same extent that its taxed under federal law.

The unemployment benefits were given to workers whod been laid off as well as self. Unemployment Federal Tax Break. 651-296-3781 or 1-800-652-9094 Email.

Welcome to the Minnesota Unemployment Insurance UI Program. Paul MN 55145-0010 Mail your property tax refund return to. For those who filed 2020 tax returns before Congress passed an exclusion on the first 10200 in unemployment benefits heres how theyll get any refund.

This is the official website of the Minnesota Unemployment Insurance Program administered by the Department of. The new law reduces the amount of unemployment. In the latest batch of refunds announced in November however the average was 1189.

This means that you dont have to pay federal tax on the. Taxes were due in mid-May so many of the roughly 560000 individuals eligible for tax breaks likely already filed their returns while others filed for extensions. On April 29 2022 the Minnesota Legislature passed and Governor Walz signed into law a Trust Fund Replenishment bill.

If you received unemployment benefits in 2020 a tax refund may be on its way to you. HUNDREDS of thousands of households in Minnesota will get tax refunds worth an average of 584 each by New Years Eve. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189.

Minnesota Tax Law Update Ppp Eidl Unemployment Minnesota Cpa Firm

Minnesota Is Forgiving 2020 Jobless Benefits And Ppp Loans So Where S The Money

Some Tax Refunds May Be Delayed This Year Here S Why Cbs News

When Will Unemployment Tax Refunds Be Issued Kare11 Com

Minnesota Budget Deal Will Bring Ppp Unemployment Tax Relief Here S What You Need To Know Kare11 Com

The State Of Minnesota Could Be Sending You Another Tax Refund

Unemployment Tax Changes How They Affect You Employers Unemployment Insurance Minnesota

Some 2020 Unemployment Tax Refunds Delayed Until 2022 Irs Says

Unemployment Tax Break Surprise 581 Checks Paid Out To 524 000 Americans In Time For New Year S Eve Marca

Unemployment Tax Changes How They Affect You Employers Unemployment Insurance Minnesota

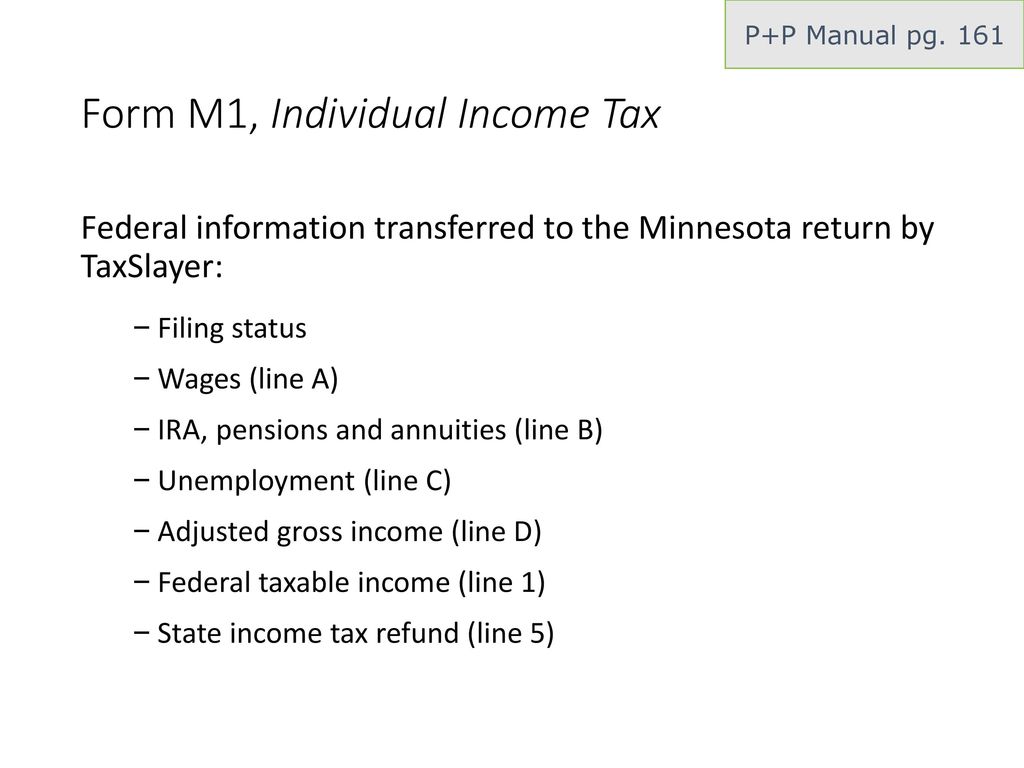

Basic C Minnesota Income And Property Tax Returns Tax Year Ppt Download

Minnesota Lawmakers In Final Push Before Holiday Break State Southernminn Com

You May Need To Amend Your State Tax Return For Your Unemployment Tax Break

Unemployment Tax Changes How They Affect You Employers Unemployment Insurance Minnesota

Tax Deal Reached In Final Weekend Of Session At Minnesota Capitol

Surprise Checks Of 584 Going Out To More Than 500 000 Households Before New Year S Eve Do You Qualify The Us Sun

You Could Get A Tax Refund For Unemployment Benefits In May

2020 Unemployment Tax Break H R Block

Year End Tax Information Applicants Unemployment Insurance Minnesota