franchise tax bd refund

This also happened to me. Manage your source tax for withholding agents Interact online with tax support team.

Amazon Com Ca State Tax Filing Envelope For Refund 6 X 9 100 Pk Office Products

You got a deduction benefit for it so now you have to include it as income.

. Meanwhile franchise taxes for LLP and LPs vary but must pay the minimum. I remember filing my tax return for 2015 and I had paid right on the money to CA I think I was owed a dollar or two back so. My return in CA is filed.

A State Tax Refund is taxable if you itemized deductions on that prior years federal return and took a deduction for state income taxes instead of the sale tax. Contact us about refunds Phone 800 852-5711 916 845-6500 outside the US Weekdays 8 AM to 5 PM Chat Sign into MyFTB to chat Weekdays 8 AM to 5 PM Mail - You may send us a letter asking for a status of your refund. If you are a withholding agent update your source tax deposit.

Register as a taxpayer. Welcome to the Barbados. File your tax return.

I noticed a 25665 direct deposit in my account this morning. Failure to fill in the amended return oval on the form when filing an amended return. All Franchise Tax Board FTB.

IN RE FRANCHISE TAX BOARD LIMITED LIABILITY CORPORATION TAX REFUND CASES. Making one checkmoney order to cover the tax liability for multiple returns. In order to claim the SR Credit your business must file an Unincorporated Business Franchise Tax Return D-30.

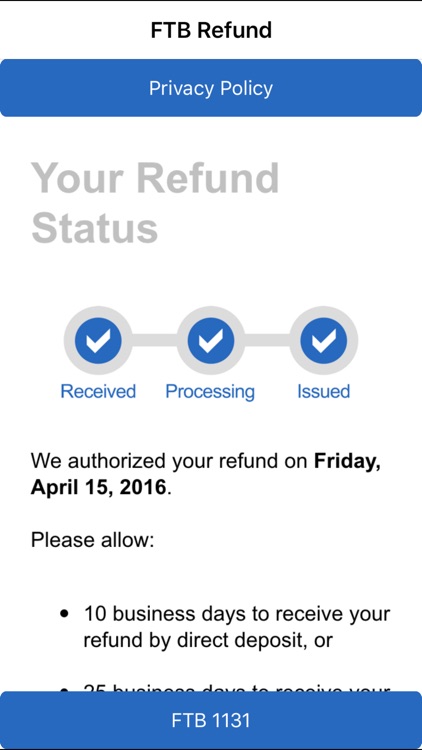

Refunds In this section you can check your account status online and track your refund being processed. Section 19385 provides in relevant part. 540 2EZ line 32.

It says FRANCHISE TAX BD DESCASTTAXRFD which google slething tells me is a CA state tax refund. If you havent filed your income taxes yet visit estimated tax payments. Respondent Franchise Tax Board FTB partially denying1 appellants claims for refund of 363301 for the taxable year ended TYE February 28 2009 2009 taxable year 319624 for the TYE February 27 2010 2010 taxable year and 512758 for the TYE February 26 2011.

Online and track your refund being processed below. I am the sole proprietor of a retail business with less than 12000 in District gross sales. Texas Comptroller of Public Accounts.

Tax Refund Cases 25 CalApp5th 369 see flags on bad law. Pay your tax online. If the Franchise Tax Board fails to mail notice of action on any refund claim within six months after the claim was filed the taxpayer may prior to mailing of notice of action on the refund claim consider the claim disallowed and bring an action against the Franchise Tax Board on the grounds set forth in the claim for the recovery of.

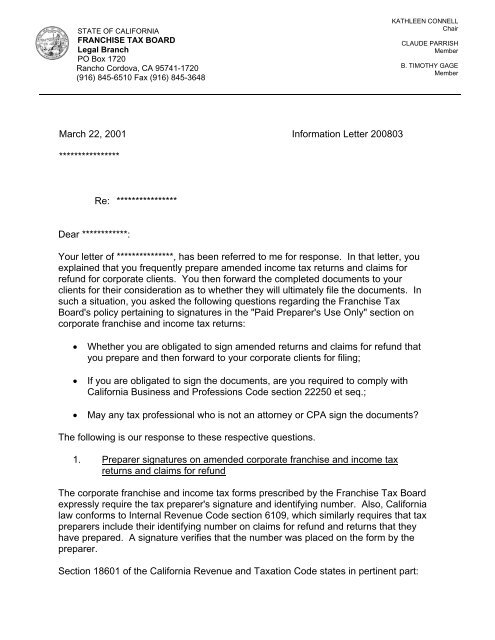

Section 19385 provides in relevant part. Unauthorized access to account information is unlawful as described in Section 502 of the California Penal Code. Section 19382 authorizes a lawsuit against the board to obtain a postpayment refund of franchise taxes and states.

Obtaining taxpayer account information is the privilege of individual taxpayers or their authorized representatives. Antolin San Francisco Edward J. Because the FTB is a tax agency one might assume it is therefore authorized only to collect tax-related debts such as debts incurred through failure to file taxes failure to pay taxes or failure to retain records in.

Read In re Franchise Tax Bd. LLCs that elect to be taxed as a corporation are subject to Californias corporate income tax instead of a franchise tax. Value Added Tax VAT Tax payers must provide the TIN and the tax return which would state the period and amount.

Technically I shouldnt have been guilty and I am fighting for it. Learn more Visit TAMIS Website. The law requires you to keep all records you used to prepare your tax return for at least three.

Refund amount claimed on your 2021 California tax return. A State Tax Refund is taxable if you itemized deductions on that prior years federal return and took a deduction for state income taxes instead of the sale tax. Depending on the size of the refund and the outstanding balance owed the FTB may claim anywhere from a small portion to the entirety of the refund.

Tax Audit Representation Against the IRS Franchise Tax Board or Virginia Department of Taxation Click Here To Call a Tax Expert 925-954-4441. Enter your tax ID the form being filed and the tax year on the payment. If you havent filed your income taxes yet visit estimated tax payments.

Please use a separate checkmoney order for each return. Just checked my bank account and apparently on 9916 I had several hundred dollars deposited into my account. California Franchise Tax Board.

Can I claim the SR Credit on my District individual tax return Form D-40. Except as provided in Section 19385 where the board fails to mail notice of action on a refund claim after payment of the tax and denial by the board of a claim for refund any taxpayer claiming that the tax computed and assessed is void in whole or in. A franchise tax is a levy paid by certain enterprises that want to do business in some states.

Franchise Tax Bd No. Silverstein Pomerantz LLP Amy L. Franchise Tax Board PO Box 942840 Sacramento CA 942840-0040.

Section 19382 authorizes a lawsuit against the board to obtain a postpayment refund of franchise taxes and states. Title says it all. Value Added Tax VAT Tax payers must provide the TIN and the tax return which would state the period and amount.

I have a traffic ticket which I extended the court date 3 months later. Using the incorrect return for the tax year. Title says it all.

Received a direct deposit in my checking account from FRANCHISE TAX BDhave no idea wherewhat it is from should I be worried. California Franchise Tax Board. Using the incorrect return for the tax year.

Beeby San Mateo Calvo Fisher Jacob LLP William N. Franchise Tax Return D-30 beginning for tax year 2018. Thats really a long delay for a CA tax refund but congrats use it fun-ly.

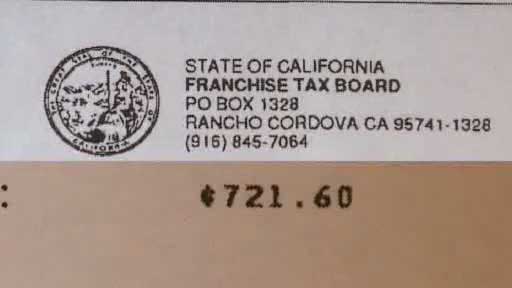

For refund information related to Franchise Tax please call 800-531-5441 ext. FRANCHISE TAX BD CASTTAXRFD 022117 XXXXX5 1600 022417 Is this something from my tax return. Update your tax payment.

How To Redeem California Tax Income Return Warrants Personal Finance Money Stack Exchange

Ppt My Ftb Account Powerpoint Presentation Free Download Id 3596684

Ftb Refund By Franchise Tax Board

Carns410 California Refund Envelope Nelcosolutions Com

What Is Franchise Tax Bd Casttaxrfd Solution Found

Missing Your State Tax Refund The Ftb Is Looking For You Campbell Ca Patch

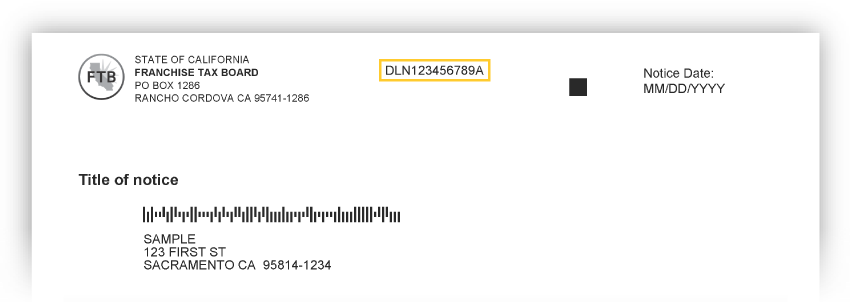

Information Letter 200803 California Franchise Tax Board State Of

California Franchise Tax Board Taking Tax Refunds With No Notice Cbs Sacramento

Franchise Tax Board Ca Ftbfiling Sc Twitter

2002 Taxpayer Bill Of Rights California Franchise Tax Board

Forms And Publications Ftb Ca Gov

Got Super Excited When I Saw That I Got A Letter From The California Franchise Tax Board But It Wasn T The Stimulus Check Anyone Else Get One Of These Letters

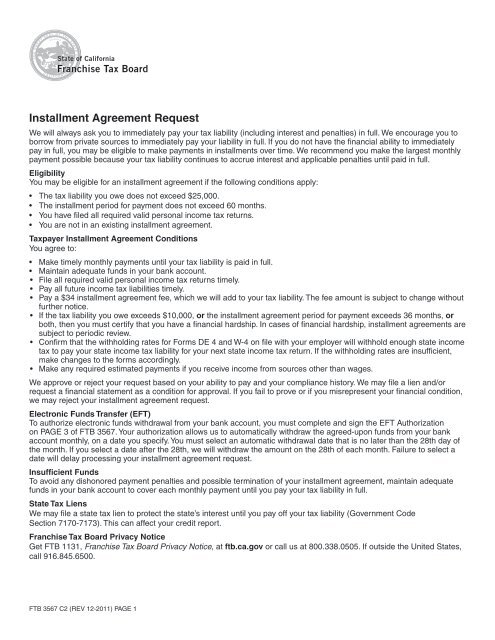

Installment Agreement Request California Franchise Tax Board